Everything You Need To Know About Key Man Insurance

You may of heard of key man insurance but were unsure of what it is or does. As a result, we’ve broken down everything you need to know …

What is Key Man Insurance?

Keyman Insurance is a life insurance policy which is written on the life of a key business employee. It is taken out by businesses to safeguard any loss of earnings and potential expenses should something happen to their key personnel. In the event of death or even critical illness should the company choose this option, the policy is paid out directly to the business.For this reason, it is the business which is responsible for setting up and paying the premiums of the policy.

Who is a Key Man?

A ‘Key Man’ is an employee whose death or continued absence would affect a company’s income or long-term profits, as well as impacting the general running of the business.

These individuals tend to operate at senior levels within a company and may include but not limited to C-Level members, Directors, Head of Departments and General Managers. In essence, anyone the business considers to be a ‘figurehead’ in the company could be eligible for Key Man Insurance.

Good to Know:

-

- Taking out a longer term premium guarantees your business a lower rate

-

- The premiums can be deducted as a business expense

-

- The time taken to approve a policy ranges from be same day to a few weeks

-

- Applications usually take no longer than 15 minutes

-

- Limited liability partnerships and limited companies are both eligible to take out Keyman insurance

-

- You can change ownership of the insurance policy if your company ceases trading or if it changes name

-

- You can cancel these policies at anytime

Setting up key man insurance for your business is often essential. We don’t usually tend to think about what we’d do if the unthinkable were to happen. How would you cover the loss of profits and pay for the cost of hiring and training a replacement?

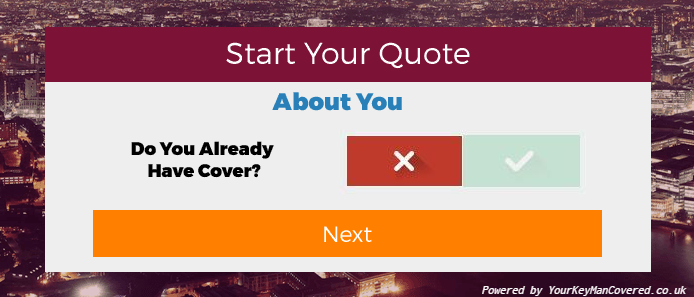

To find out more, get a free, no obligation quote today by clicking below and filling out our short form…

We think it's important you understand the strengths and limitations of the site. We're a journalistic website and aim to provide the best Money Saving guides, tips, tools and techniques, but can't guarantee to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. This info does not constitute financial advice, always do your own research as well to ensure it's right for your specific circumstances and remember we focus on rates not service. We often link to other websites, but we can't be responsible for their content. This site is in no way affiliated with any news source. As mentioned above it is an advertisement. This site contains affiliate and partner links. Any testimonials on this page are real product reviews, but the images used to depict these consumers are used for dramatization purposes only. This website and the company that owns it is not responsible for any typographical or photographic errors. If you do not agree to our terms and policies, then please leave this site immediately. All trademarks, logos, and service marks (collectively the "Trademarks") displayed are registered and/or unregistered Trademarks of their respective owners. Contents of this website are copyrighted property of the reviewer and/or this website.

© Copyright Your Money Saving 2021 - All rights reserved